The cosmetic industry often evaluates a company’s New Product Introduction Process (NPI) by its ability to get to market quickly and efficiently. If not managed well, non-compliance can be detrimental to the efficiency and swiftness that a new product is brought to the market and can lead to increased risk, extra costs related to reformations and re labeling, and legal obligations due to unsafe products.

The subsequent damage to the company’s reputation can be just as painful and difficult to manage as the monetary penalty, and it can take years to regain consumer trust, shareholder confidence, and lost market share.

While the cost of ensuring regulatory compliance in the cosmetic industry can be significant, especially for smaller, niche manufacturers with limited funding and tight budgets, the cost of non-compliance is much higher and can have far-reaching ramifications for the organisation.

Regulatory non-compliance can result in costly reformulations, product launch delays or recalls, documentation or packaging changes, and legal – and financial - obligations if a product is deemed unsafe.

By taking the time to establish a strategic and well-defined new product introduction process that incorporates a robust regulatory compliance plan, cosmetic manufacturers can secure their place in the market while protecting themselves from the financial fallout and public relations nightmare that can result from regulatory compliance violations.

New Product Commercialisation and Regulatory Compliance

The financial implications of regulatory non-compliance in the cosmetic industry can be significant – and damaging – to a cosmetic manufacturer, and it is well worth the initial expense of implementing a robust compliance plan in order to avoid this type of unnecessary expenditure and exposure.

It is important to remember that every step of the product commercialisation process is subject to non-compliance penalties and early identification of potential compliance gaps could save a manufacturer from unplanned costs that could jeopardise the financial standing of the company.

The same rules apply to cosmetics, where even processes that seem straightforward can incur sizable and unanticipated expenses if regulatory compliance is not properly monitored or enforced.

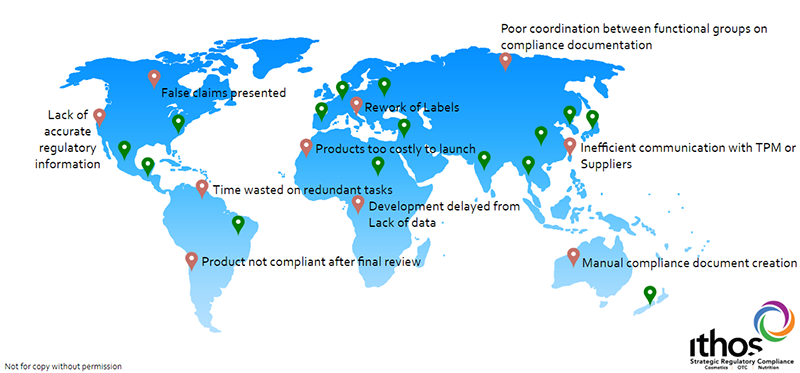

Identifying the Hidden Costs of Regulatory Non-Compliance

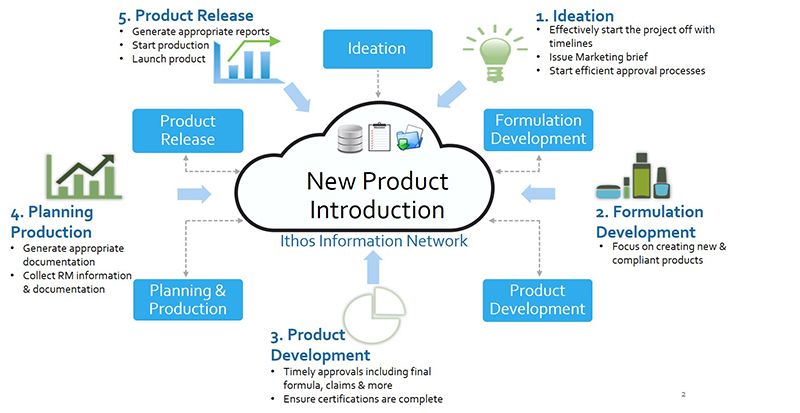

A robust new product introduction process typically includes six stages – or gates – following the product from ideation to commercialisation. Each stage of the product development lifecycle has a regulatory compliance component and needs to be carefully budgeted to ensure the finished product will be profitable.

These are just a few examples of how quickly compliance issues can impact project and organisational budgets:

- Inability to find and transfer documents - EU and FDA cosmetic regulations require that compliance information for a product be shared between brands, manufacturers, assessors, competent authorities, and designated responsible persons. Without a shared, central place to store documents and a unified file naming convention, finding the document you need (and the most current version) can be like looking for a needle in a haystack. Files get saved on local drives and are inaccessible to other team members, get lost when employees move on, and Google drives are difficult to manage. Searching for documents that should be easily accessible leads to wasted time and redundant work

- Product Reformulation – This can be a very expensive undertaking for a manufacturer if proposed ingredients are not appropriately screened for compliance prior to initiating product development. The total costs to replace even a minor ingredient in order to achieve compliance can run roughly as high as $232,000 per formula, including research, safety testing, product packaging and labelling and manufacturing process changes.

For replacement of a major ingredient, these costs can run as high as $676,000 per formula, and if a formula is reworked more than once to replace a major ingredient for patient safety issues, the cost can exceed more than $1 million. Because the same formulation is often sold under multiple SKUs, these costs can quickly overwhelm the project budget and impact market profitability - Missing the Marketing Brief – The marketing brief defines the target market for the product or products, and the market segmentation is determined in part by the ingredients used in the formulation. International regulations vary from country to country, and the marketing team should be made aware, early whether the targeted jurisdictions allow use of the proposed ingredients, as recalling products from those markets and/or reformulating a product after its market release can be very expensive.

- In addition, the marketing team works with the regulatory department to define the intended use and performance claims for the product, based on the safety testing and study/claim substantiation data. Promoting any use of the product that is not supported by substantive factual evidence is risky and may result in publicised product recalls and considerable financial penalties

- Delayed Product Launch - This can impact not just the project metrics but also the manufacturer’s overall bottom line, as annual revenue projections typically include the income from sales of new products. Reformulations and other product changes necessitated by non-compliance affect the approval timeline, which in turn impacts the launch timeline, negatively impacting the financial health of the entire organisation.

Non-Compliance Case Study

When Company X, a large, multinational cosmetics and personal care brand, launched in multiple countries, it was working under an aggressive and immovable launch date. In the rush to market, the company didn’t realise key product compliance reporting information was incomplete and inaccurate and they could not locate the documents they needed in a timely manner. The result? Over a quarter of a million dollars in unplanned costs.

What happened:

- Product was held at customs for months

- A re-formulated product had to be air-freighted at the last minute, resulting in higher costs

- Local teams had to be hired, trained, and managed to re-label the products, in some cases multiple times.

The consequences of non-compliance included: the cost of air-freighting products, shipping labels, plus related expenses of hiring staff and warehousing. Plus, a window of time (measured in months) opened for competitors to wedge into an opportunistic market.

If missing documentation is noticed before your product launches, the costs are typically only financial.

However, as mentioned before, launching a product with incomplete or incorrect documentation is a brand issue. Not only is there a hit to the bottom line, but damage to one’s reputation can be significant if there are product recalls, significant press, or lawsuits.

Indie brands face do-or-die consequences: A smaller company, brand ‘Y’, shipped product overseas for a critical product launch, only to have customers return the shipment because several ingredients weren’t compliant.

The fledgling product ended up not going to market. As a small indie brand cosmetics company, they could absorb the additional costs it would take to rework, relabel, remarket, and reship the product. This direct hit to the bottom line at Company Z had one primary cause: the employees’ inability to find compliance.

The Cost of Compliance Versus Non-Compliance

The cost of compliance versus non-compliance in the cosmetic industry should be a calculated consideration for any cosmetic manufacturer, no matter the annual sales, number of SKUs, or number of employees.

A robust compliance system can eliminate the need for costly rework while minimising the risk to consumers and the organisation. Cosmetics manufacturers investing in compliance will reap the benefits for years to come with a competitive advantage that allows them to remain compliant and profitable.

Consider these successes of compliance:

- Ingredient approval processes and reviews that use to take weeks are now automated to where cycle time is reduced by 50-75%

- Marketing processes can move forward knowing that the formula is approved by the regulatory team

- Supplier documentation can be located quickly in one central repository, and attributes easily queried

- Increase time to market and make target product launches

- Eliminate rework and any associated costs.

Compliance Software

What a compliance solution should do is allow companies to automate all compliance-related communications and data throughout a company and supply chain – and bring that data into a central repository where it can be looked at, worked with, and reported in a simple manner.

This is increasingly important during this time where uncertainty exists in product sales in global markets and companies are pushing to remain productive and prepare themselves for returned market demand. The solution lies in taking a proactive approach now. Compliance with any authority is only as good as the tracking tools, data, and technology behind them.

Focus right now should remain on compliance and building centralised databases, normalising file names, sorting document types, and mining attribute data. By organising your data and building centralised repositories you will enable other Business Information Systems to communicate effectively.

Raw material and ingredient data, as well as changing regulatory data, requires a centralised database that organises not just the documents but the data in them.

A person can check documents in and out of an ERP and PLM system, but if you can’t extract detailed ingredient and raw material information from those documents, there’s no use. You may as well store hard copies in an overflowing file cabinet.

In a time where companies are setting their sights on market demand returning it would be a waste to accept the losses of time and resources while assuming there will be room to react to issues when they arise.

Teams and leaders need access to up-to date regulatory information and granular product information that can be extracted and manipulated. Only then can a company design and execute realistic compliance processes, project plans, and launch dates for the future. Don’t be inactive, be proactive.

In Closing

Global regulatory compliance – from Lacey Act to REACH to Prop 65 and many others – remains a challenge for businesses today, but it is critical to avoid the ramifications of being non-compliant.

Flexibility, customisation, reporting, and transparency should be key features for any information management platform being considered for adoption. A platform like the Ithos Information Network (IIN) brings all the pieces together to provide a full-service compliance solution for tracking new product introduction metrics, visualising workflows across departments, pinpointing where delays occur, and meeting compliance the first time.

If you’re interested in learning more about how you can avoid non-compliance and increase efficiency and ease launching new products or expanding existing products, contact Ithos Global for assistance.