Russia’s economic woes are well documented and following a comparatively healthy 2015, the country’s personal care market is now beginning to contract. Strong currents appear to be instigating long term changes to the sector, notably an increasing preference for cheaper products by hard-pressed consumers.

According to US-based consulting and market research company Kline Group, the economic crisis led to a drop in personal incomes, with household incomes of Russian families down by 30% in real terms since 2008 while inflation is putting pressure on all purchases. A rise of 35% in grocery prices over the past three years is relevant, says Kline, because consumers will always prioritise groceries over all but the most basic of toiletries. According to the World Bank, GDP fell 3.7% in 2015 and shrank by 0.9% year-on-year in the first half of 2016.

“Oil prices have influenced the economic slowdown in Russia since the end of 2014,” says Olga Murogova, Senior Research Analyst at UK based market intelligence company Euromonitor International. “One of the affected areas is consumer disposable income, which in real terms dropped by almost 10% in 2015 and declined further in 2016. Within the beauty and personal care industry this reflected in consumers trading down and searching for promotions.” She added that the devaluation of the Russian rouble has led to high unit price hikes, “as many brands or ingredients for beauty and personal care products are imported”.

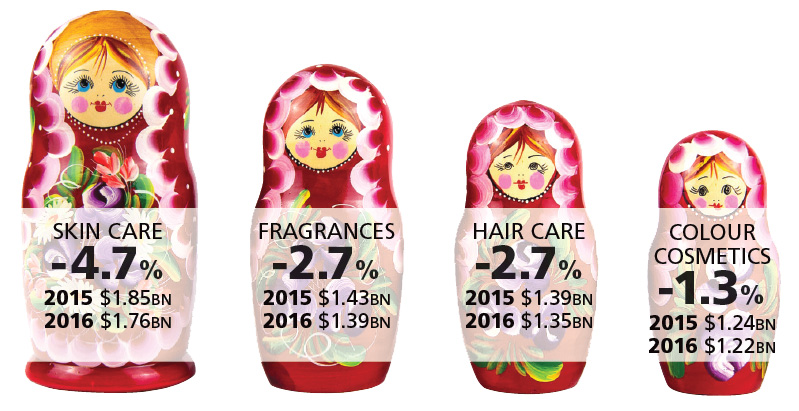

Russia beauty & personal care market, 2015 vs 2016*, US$bn

Source: Euromonitor International. * = forecast

A Year To Forget

According to Euromonitor’s 2016 forecasts, Russia’s beauty and personal care market was worth US$8.73bn in the calendar year 2016, down 2.2% on 2015’s total of $8.93bn. Skin care was the largest category at $1.76bn, followed by fragrances ($1.39bn) and hair care ($1.35bn). Colour cosmetics was worth $1.22bn, while Russia’s men’s grooming market made sales of $1.12bn.

In percentage terms, the only beauty and personal care category worth more in 2016 than in 2015 was the baby and child-specific products market, which grew 2.2% to reach $336m.

Deodorants, the second best performing category, stalled at $399m in 2016 with zero growth. The hardest hit category last year was depilatories, which dropped -5.5% on the prior year and, although it was the strongest category in dollar terms, the skin care market also fared poorly with sales down -4.7% on 2015.

Despite the rouble devaluation and the poor performance of the beauty and personal care market in 2016, Russia remains the largest market for cosmetics in Eastern Europe and accounts for 50% of the cosmetics retail market in the region, according to the Russian Federation’s Ministry of Industry and Trade.

Russia’s professional hair care market likewise suffered. “Sales growth was less than 10% in 2015 and has been the lowest in the past five years, as the economic environment in the country is getting worse,” says Ewa Grigar, an analyst for Kline Group. “Both professionals and consumers are looking to reduce spending.” Kline expects Russia’s salon hair care market to grow at a CAGR (compound annual growth rate) of less than 2% between 2015 and 2020.

Among the strongest Russian beauty and personal care companies internationally are

Faberlic and Splat Kosmetika

No Patriotic Push

That said, leading hair care brands St Petersburg-based Russian hair product specialist