Growing consumer and regulatory demand for sustainability in consumer markets is redefining the packaging sector, and the beauty segment is no exception. As a result, airless packaging – while sometimes expensive – offers virtues such as the ability to preserve product freshness, minimal oxidisation, low wastage and efficient dispensing that can dovetail with greening market trends.

The mechanics of airless

The need to link the efficacy of airless with sustainable solutions is certainly promoting innovation.

A Silver VTX Slimline Airless Pump, launched in March by Glasgow, Scotland-based Richmond Containers, is a case in point. The effectiveness of this technology means that “your skin care, cosmetic or tanning formulation can avoid the need for preservatives”, Gavin Steven, Technical Sales Representative at Richmond Containers, tells Cosmetics Business.

The key difference between a lotion pump and a truly airless pump, says Steven, is that the latter utilises a piston in the base.

“This is a small plastic disc, which pushes the skin care or other cosmetic product towards the dispensing nozzle at the top. When the actuator is pressed and the product inside the container is dispensed, this creates a small vacuum within the chamber,” he says.

To regulate this change in pressure, the disc moves upwards, compressing the product, which is why there is a small air hole in the base, allowing air to replace the void created by the shrinking product area.

“One of the airless benefits is that, due to this piston, the product isn’t exposed to air until it is dispensed,” explains Steven, which means preservatives are not needed. On the contrary, in a lotion pump, when the product level in the container slowly decreases, the space is replaced by air coming back in through the top.

“This can potentially degrade your product more quickly compared with a truly airless pack,” adds Steven, noting that the pump comes in matte silver with a gloss silver actuator.

Another innovation is the airless packaging for Hepta-Peptide, a serum that reduces the appearance of fine lines and wrinkles, produced by skin care brand The Inkey List.

The serum is delivered through a 30ml pack with a D.N.Airless 35mm-diameter pump from France’s Albéa, which is supplied in the UK by Norwich, eastern England-based packager Vetroplas Packaging.

“The pumps benefit from Albéa’s Nea neutral engine, which guarantees no contact between the bulk formulation and metal parts,” Vetroplas’ Sales Director, Simon Dix, tells Cosmetics Business.

“The delivery system ensures more than 95% evacuation of product and the D.N.Airless packs are generally lighter than similar offerings on the market.”

Moreover, the white polypropylene (PP) bottle features gloss black pumps and overcaps with silk screen printing in black ink, completing a simple yet sophisticated look.

Pump up the green

In the US, California-based SeaCliff Beauty Packaging & Laboratories has been trying to go one better with the airless-sustainability trend. In a February note, it explained how it has created a refillable airless pump container.

“You refill the container with new airless pumps utilising the same housing or component, so it is not a refillable pump, but rather a container that you can replace,” SeaCliff Beauty owner and CEO Vonda Simon tells Cosmetics Business.

Besides, “we also have eco airless pumps that have no springs or balls in them, only all PP and some PE parts”, Simon adds, noting that in the US, airless pumps are still a huge market because of their ease of use, “100% evacuation of product and shelf presence”.

According to Big Market Research data, the American and UK markets for airless packaging (including cosmetics) were valued at US$682.4m and $217.45m in 2016, respectively. And globally the airless packaging market is set for impressive growth.

“The global airless packaging market is estimated at around $4bn in 2016,” Big Market Research analyst Yash Doshi tells Cosmetics Business.

Of that, Europe accounted for more than one third of the market share, whereas the LAMEA region (comprising Brazil, South Africa and other Middle East countries) is expected to witness the highest growth during 2017-23.

While airless packaging has long been a favourite for luxury cosmetics makers, the format is gradually making its way to the mass segment

And the global market is forecast to grow at 5.9% to 2023 on the back of a “surge in need for ecological products” coupled with a sharp rise in “demand for skin care and hair care products in developing countries”, Doshi says.

Besides, airless technology ensures the product is protected from degradation (mainly oxidation), shelf life is increased and almost 95% of the content can be utilised, well in keeping with the global sustainability trend, Doshi adds.

Going a step further, Italy-based cosmetics packager Lumson has developed an airless pack made from Green PE: a new packaging material produced using sugarcane ethanol, an alcohol-based, renewable fuel.

While the production of traditional polyethylene requires fossil fuel resources such as oil or natural gas, the manufacturing system used to make Green PE captures and fixes CO2 from the atmosphere during manufacturing, thereby reducing overall greenhouse gas emissions.

Lumson decided to apply Green PE to its standard plastic collections and its airless systems, according to a company note, which states: “This combination helps attain the goal of maintaining the technological integrity of the airless system while at the same time, being environmentally conscious.”

Available in 30ml and 50ml capacities, its pouch-based airless system ensures zero air intake, which protects sensitive ingredients and reduces the use of preservatives, while the system is also designed to prevent tampering, adding an extra layer of security protection for retailers and consumers, according to the company.

Indicating innovation

Similarly, in South Korea, airless packaging remains a key focus of innovation in a beauty industry driven by intense competition with western and other Asian cosmetics manufacturers – and here too there is an increasing desire to promote sustainability.

Out-of-the-box airless designs have been popular in South Korea since they emerged in the 1980s, driven by Korean consumers’ desire for convenience, functionality and sustainability. And the use of these systems is still growing in South Korea’s personal care product market.

“More Korean brands are turning to airless packaging amid the growing call from consumers and regulators for more natural and ‘clean’ cosmetics with less chemical additives,” says Bobby Verghese, an analyst with market researcher GlobalData.

Speaking to Cosmetics Business, he adds that: “Airless packaging also offers an alluring proposition to Korean consumers who are leading dynamic lifestyles.”

He says this reflected a 2018 GlobalData consumer survey, which noted that 34% of South Korean consumers say how well airless delivered products are “tailored to their needs”.

And the plethora of airless product launches has continued. For instance, COSRX Light Fit Real Water to Toner Cream, which came out last year, is a moisturising cream and toner hybrid sold in an airless pump container, exuding the formula in almost solid white ribbons, with gaps and curls. The formula rapidly becomes softer and almost liquid when applied.

Another 2018 South Korean airless environment launch was Neogen Super Hydra Aqua Capsule Mask, a sheet mask sold with an ampoule containing hyaluronic acid. The pack-integrated ampoules are snapped in their middle and doused on the mask during application.

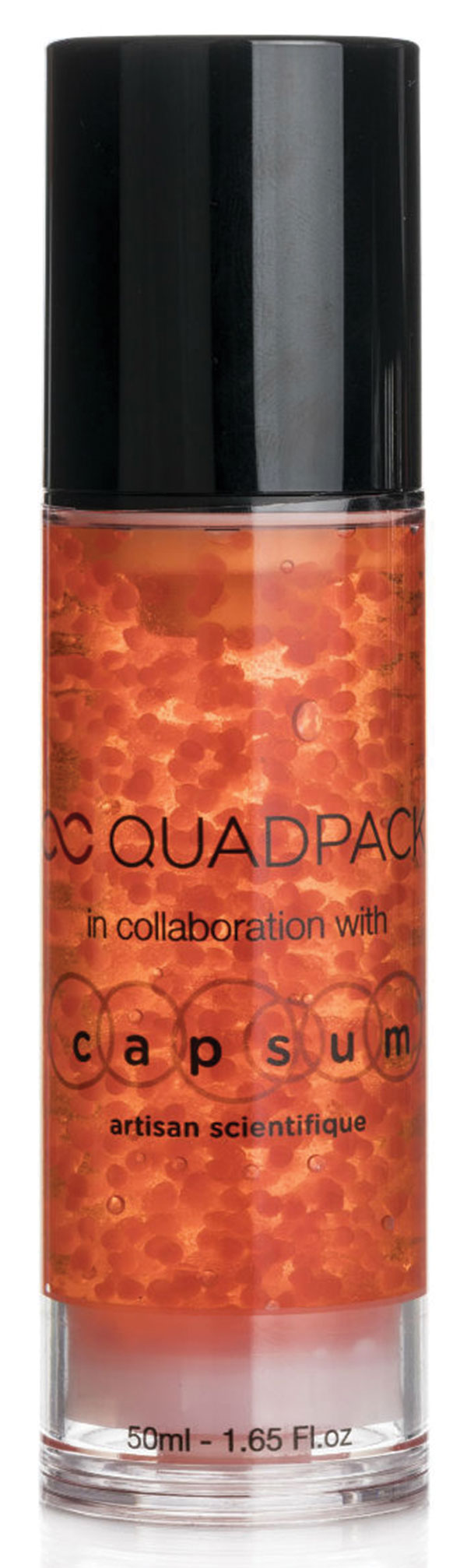

Capsule Airless, the main airless pack launched by major South Korean cosmetics packaging maker Yonwoo in November, takes another approach by allowing beads to pass through the pump intact to burst when massaged onto the skin. The pump dispenses doses of 0.5cc. Products applied this way include anti-ageing or lifting serums.

Spain-based manufacturer Quadpack noted that the pump enables evacuation of all of the product right to the end, with no wastage. Indeed, “airless is still very trendy”, Julie Vergnion, Skincare Category Manager at Quadpack, tells Cosmetics Business.

“The market is looking for packs that are not only airless but offer strong protection of the formula, with the rising popularity of preservative-free, natural and organic products,” she adds.

“While airless packaging has long been a favourite for luxury cosmetics makers, owing to its high end aesthetics and ergonomics, the format is gradually making its way to the mass segment,” notes Verghese.

Communicating eco benefits

There is maybe less airless innovation in South Korea’s key competitor Japan, however, with packaging manufacturers having made few advances in the field for the personal care and cosmetics sector.

Beauty companies seem to have been apparently content with the makers’ existing line-ups and more focused on communicating other elements of their packaging to end users, notably its sustainability.

“Airless packaging technology is already very good in Japan and personal care companies see this as less of a priority in promoting sales of their goods,” says Ayumi Kamimura, a spokeswoman for Tokyo-based Yoshida Cosmeworks.

“Whereas saying that a container would not allow the air to get in and interact with the product would have been a sales point in the past, consumers are now demanding packaging that can be shown to be environmentally friendly,” she tells Cosmetics Business. “And that means companies have shifted their focus and the trend now is for green and recyclable packaging.”

Consequently, Yoshida Cosmeworks – one of the biggest manufacturers for domestic personal care companies – has not released a new airless packaging product in the last two years, Kamimura says.

The company is, however, expanding its use of ethylene vinyl alcohol (EVOH) in a wider range of packaging products to take advantage of its antioxidant barrier functions. Already used in the company’s tubes for cleansing products, work is underway to apply the copolymer in other packaging, including jars.

Takemoto Packaging released its TV-25φ nozzle tube last year, which incorporates a one-way valve in the nozzle to prevent air entering the tube, according to company spokesman Sean Kaku.

“This is a small-capacity tube with a check valve function,” Kaku says.

“The design of the nozzle makes it easier to get to the targeted place, and the tube can be used for applying products such as skin care lotions and make-up.”

The check valve prevents the contents from oxidising, while the EVOH material used in the tube serves as an “excellent barrier” that stops the contents from being exposed to outside contaminants and even blocks smells from escaping.

Shinji Yamada, Executive Officer, Comunication Planning Division at cosmetics maker Chifure Corp, stresses conservatism in the industry, which is driven by consumers wanting to know that product packaging is airtight. This means packaging and product manufacturers push “technology that is already tried-and-trusted where they know there will not be any technical problems”.