Market overview: At a glance

What's in this report?

Introduction

Top 5 trends:

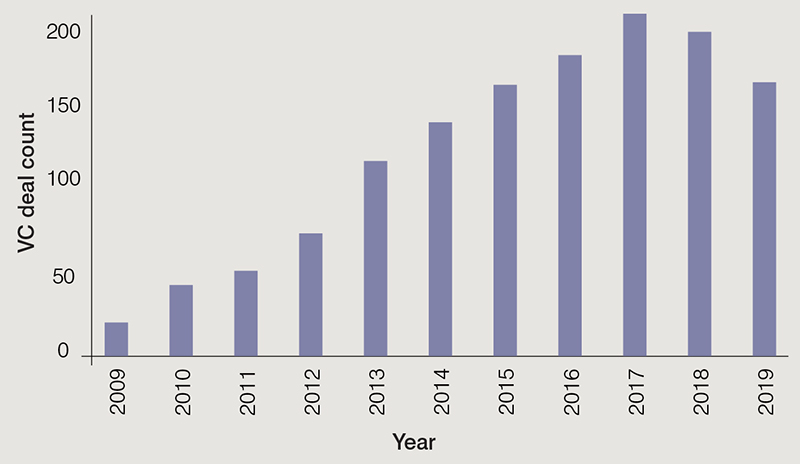

Beauty start-ups: Number of VC deals by year, 2009-2019

Source: Crunchbase. Data as of 16 April 2020

Key market challenges addressed

Both challenged and challengers, beauty start-ups face many hurdles on their journey, but they also create them for other players in the industry.

With large corporations being less nimble and more risk adverse, start-ups are able to challenge the status quo, react quickly to trends and have greater social purpose and individual purpose – all of which are enticing factors for today’s consumer.

“Consumers are looking to move away from larger companies, to favour independent brands,” says Fiona Glen, Head of Projects at beauty brand consultancy The Red Tree.

Not yet a Subscriber?

This is a small extract of the full article which is available ONLY to premium content subscribers. Click below to get premium content on Cosmetics Business.

Subscribe now Already a subscriber? Sign in here.Featured companies

The Red Tree Consultancy

The Red Tree is the UK's leading international beauty brand consultancy. We develop and steer your ideas, challenge your thinking, and deliver results. We have an unparalleled...

The Red Tree Consultancy

The Red Tree is the UK's leading international beauty brand consultancy. We develop and steer your ideas, challenge your thinking, and deliver results. We have an unparalleled...

Bespoke Advantage

Bespoke Advantage is a London-based consultancy, with over 60 years combined experience, specialising in supporting our international client base in developing and building...

Bespoke Advantage

Bespoke Advantage is a London-based consultancy, with over 60 years combined experience, specialising in supporting our international client base in developing and building...

- Companies:

- Beiersdorf

- L'Oreal

- Euromonitor International

- L'Occitane

- Louis Vuitton Moet Hennessy

- Mintel International Group

- Kline and Company

- Shiseido

- WGSN

- The Future Laboratory

- Facegym

- Glossier

- Ethique

- Monat Global

- Founders Factory

- Five Dot Botanics

- Drunk Elephant

- Base Beauty Creative Agency

- CB Insights

- Alantra

- British Beauty Council

- Josh Wood Colour

- Spate

- Starface

- Wild Deodorant

- Monpure London