Market overview: At a glance

What's in this report?

Introduction

Top 5 trends:

1. Pimple power

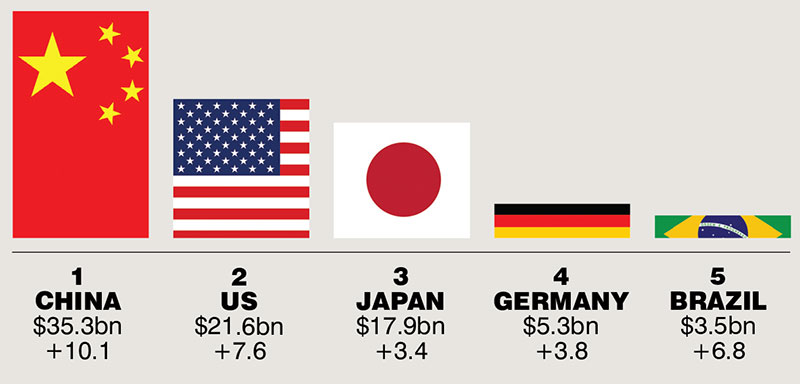

Top 5 skin care countries, value and growth, 2019

Estimated figures. Source: Euromonitor International

Key market challenges addressed

Skin care continues to dazzle as one of beauty’s fastest growing categories, but the demands on brands are intensifying just as rapidly. The challenges are numerous, ranging from the need to adapt to the changing perceptions of ingredients to expectations on sustainability as well as addressing diversity and inclusivity, connecting with consumers more closely and demonstrating authenticity and transparency, all while being a brand that makes the consumer’s pulse quicken.

Not yet a Subscriber?

This is a small extract of the full article which is available ONLY to premium content subscribers. Click below to get premium content on Cosmetics Business.

Subscribe now Already a subscriber? Sign in here.Featured companies

- Companies:

- L'Oreal

- Euromonitor International

- Louis Vuitton Moet Hennessy

- Johnson and Johnson

- Free the Birds

- Oriflame

- Kantar

- Mintel International Group

- The Red Tree Consultancy

- Revlon Group

- NPD Group

- REN Skincare

- Glossier

- Mother Dirt

- Drunk Elephant

- Biossance

- SkinSense

- Starface