Market overview: At a glance

What's in this report?

Introduction

Top 5 trends:

2. New formats

3. Transparency

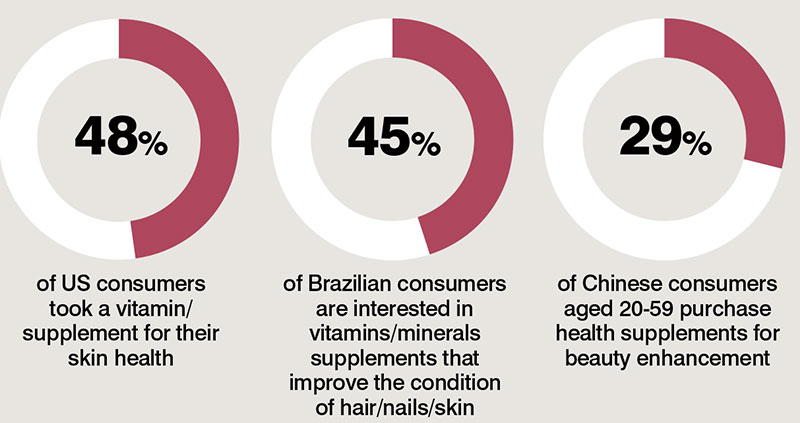

Consumer demand for beauty supplements, 2017-2018

Source: Mintel

Key market challenges addressed

Beauty supplements may still be a niche market – only 1.4% of the UK population for example have bought beauty supplements in the past year, according to Kantar – but the space is also seeing record-breaking sales, with consumers spending more in the category.

By 2024, it is forecast to double globally from its value in 2016 to reach $6.8bn (source: Goldstein Research).

Global value, 2017

Source: Analytical Research Cognizance

Yet the key task for beauty supplement brands over the coming years will be to recruit higher numbers of consumers into the category – and convince them to stay. “It’s both an opportunity and a threat that penetration is so low,” says Fiona Glen, Head of Projects at beauty brand consultancy The Red Tree.

“One of the problems is that consumers might not take supplements regularly or for the recommended time in order to see the effects. This is especially the case with products that need to be taken for three months before they start to work. There is an opportunity to make sure people are taking them for as long as they should be.”

Another barrier is price, adds Matt Maxwell, Consumer Insight Director of Kantar. “We have seen growth but we are talking about quite a high value product, on average £5 per pack, so encouraging people to break into the category can be hard because of the price point.