Market overview: At a glance

What's in this report?

Introduction

Top 5 trends:

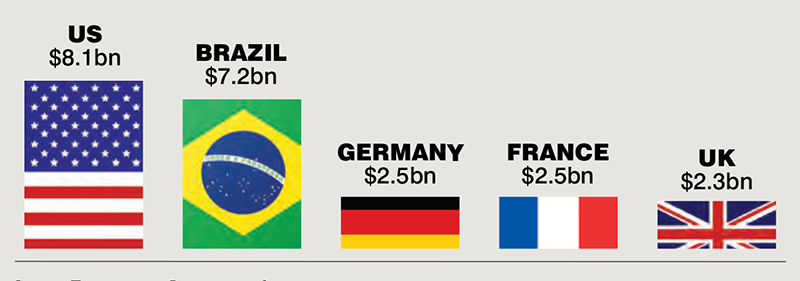

Fragrances: Top 5 countries by size, 2017

Key market challenges addressed

More than 2,400 new fragrances launched in 2017, among them some blockbusters from the biggest brands in the business: Chanel’s Gabrielle, Dior’s Miss Dior, Gucci’s Bloom and YSL’s Y.

Yet even these launches – and the considerable marketing investment that supported them – have done nothing to address one of the fragrance industry’s key challenges: how to recruit new consumers into the category.

“We have had so many important launches, yet there has been no real growth for the category,” says Mathilde Lion. “We don’t have a new Angel every day, or a brand that is changing the course of things,” adds Lion. “It is time for a different approach – we need to look for other ways to improve the category, and we need some real innovation.”

Other issues include competition from other highly innovative and successful beauty categories. In today’s social media-driven world, it is hard for the less visual fragrance sector to keep up.

“Compared with make-up and now skin care, fragrance lags behind,” says Lion. “As long as we remain in a world defined by look and image, this is a difficult issue for fragrance. To have the same impact on social media as other categories fragrance needs to find other ways.”

Retail is another challenging area for fragrance with footfall in bricks-and-mortar stores declining.

Yet there are ways that the industry can address each of these challenges, from creating new ways to wear fragrance to completely rethinking how we experience fragrance, and the benefits that it can bring consumers.

Angela Stavrevska, UK Creative Director and Perfumer at CPL Aromas, adds: “I think the in-store experience needs to be much more consumer-focused, as opposed to being merchandised by brand, distributor or licensing company. Most people would go into a store to buy perfume by smell – not by brand or distributor.

“And why do you only receive free samples once you’ve bought a fragrance? The big brands should be falling over themselves to give people samples of their latest launch, especially when the market is in such flux.”

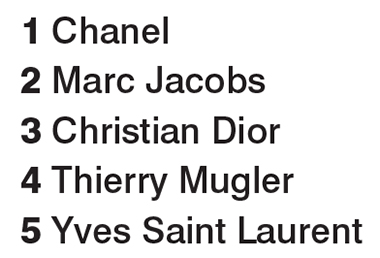

UK: Top 5 female fragrance brands, 2017

Source: Kantar Worldpanel